Ask The Question Campaign 2023

05/05/2023 (Staff Post - Yvonne Hughes )

A blog from Yvonne, the Affordable Credit Officer for Renfrewshire Affordable Credit Alliance

A new campaign from the Scottish Illegal Money Lending Unit wants us all to #AskTheQuestion this spring. This is a campaign to get us talking about and asking yourself and others – can you spot, or have you used an illegal lender or loan shark?

The campaign wants you and your colleagues and employees, family and friends to be aware of the rising risks of turning to illegal lenders in our communities and online. A report from the Centre of Social Justice called ‘Swimming with Sharks’ investigated illegal lending activity in England and, while it does not cover Scotland, we can presume that similar statistics and loan shark tactics are at play in our country.

Cost of Living Impact

The cost-of-living crisis casts a looming shadow of financial anxiety. Polling conducted by Opinium for the Centre for Social Justice (CSJ) suggests that almost 17 million people – that is, almost a third of the UK adult population – say that they are very worried about the cost-of-living crisis, rising to 42 per cent of those on the lowest incomes. The combination of pressures on household budgets, low financial resilience (meaning people's ability to have money to cope with a big financial change like a loss of income or a new baby in a household) and increasingly limited credit options is liable to create a perfect storm in which people are driven towards exploitation.

The latest data from the Office for National Statistics shows that due to the cost-of-living crisis, more people are using credit. Around 1-in-5 adults are borrowing more money or using more credit and monthly spending on debit and credit cards has increased. In addition, two-thirds of adults have reported spending less on non-essentials, so it is clear people do not have enough money at present.

Given this context, the continued scale of the problem and its devastating impact on the lives of the most disadvantaged people in society, the CSJ believes that we must urgently renew the fight against illegal money lending.

Loan sharks

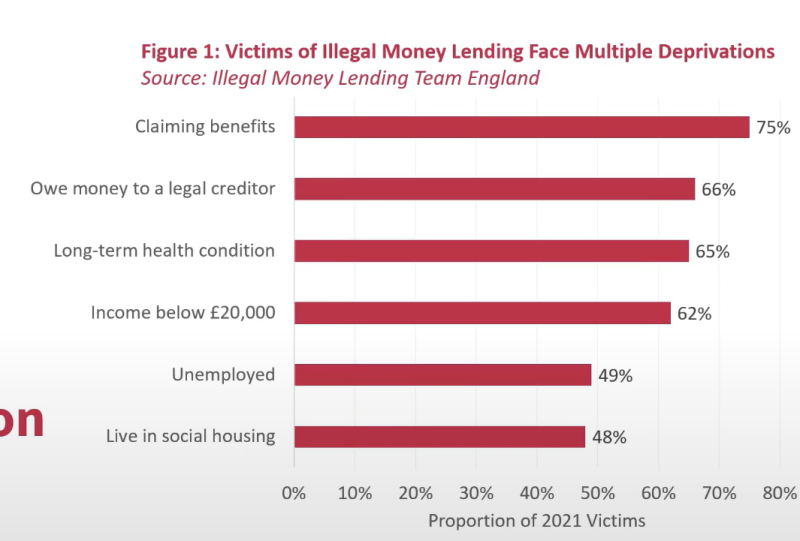

Illegal moneylenders, often known as loan sharks, are those who lend money to people without valid credit authorisation from the Financial Conduct Authority (FCA). Loan sharks usually advertise by word of mouth and appear friendly and accommodating at the start. However, they prey on the most vulnerable people in society and cause immense misery. The table below shows who is affected the most and who are targets for loan sharks.

How to spot a loan shark

Up to 61% of people who borrow from loan sharks see them as a friend, perhaps someone at the school gates has overheard you talk about needing money and offered to help, or a work colleague has pointed you to someone who lends small amounts. There are now people lending out money online, so you do not know from whom you are borrowing. This is often how people start to get caught up in a spiral of debt, by trusting someone who is not trustworthy.

61% of victims knew their lender when they borrowed, 56% considered them a friend.

This is how to spot a loan shark

- You were offered a cash loan. Loan sharks traditionally deal in cash but be aware that they may operate online too.

- A lack of paperwork. All legal lenders will provide you with the necessary paperwork explaining the terms of the loan. Loan sharks won’t give you a formal agreement.

- A lack of clear information about the loan, such as the interest rate and repayment terms. Loan sharks may be vague about the amount of interest they charge and when exactly the loan would be paid off.

- Lending with no checks. Unlike authorised lenders, loan sharks won’t conduct credit checks or affordability assessments.

- Take any of your possessions as security. Loan sharks may take valuables, or even items such as your passport or bank card, which they say will act as “security” on the loan.

- Threatening and violent behaviour. Loan sharks may use intimidation and force if you don’t pay back the loan, which authorised lenders would never do. This could be in-person or online via threatening messages, for example.

- Your loan never gets paid off. Once loan sharks get you to borrow money once, they are likely to charge such high interest rates you won’t ever repay it in full. They may also lend you more money or add further charges, so you stay indebted to them.

- If someone you recently met offers to lend you money. Even if they seem friendly and you think you can trust them, if you don’t know them very well, you should always be cautious if they offer you a loan.

If you have used or are using a loan shark you are not breaking the law, it is the people who lend out money who are breaking the law.

Ask the question

The main reason for using an illegal moneylender is the refusal of credit from a legal lender, such as a bank. Refusal is common and can be for a variety of reasons such as a poor credit rating, or your income is not guaranteed to make the repayments. In some cases, you may only need £50 when the bank wants you to take out a minimum of £1000. In the long-term taking out more money than you need can become unaffordable.

Victims borrow from loan sharks as a last resort after trying other sources

80 per cent of victims who attempted to borrow from legal sources first are refused

44 per cent of victims who try to borrow try a bank

27 per cent of victims who try to borrow try a high-cost-short-term credit provider

When this happens and there is nowhere else to turn to, what can you do? This could be a point of no return where people consider using illegal lenders, so #AskTheQuestion:

- Have you ever used a loan shark? This could be in person or from someone online?

- Do you suspect a friend or family member may have used a loan shark, are you concerned for them? Have you asked them?

- Has a professional money advisor asked whether you have used a loan shark? The Renfrewshire Citizens Advice Bureau and Advice Works support people in debt. Have they asked you if you are a victim of loan sharks?

What Can Trading Standards Do?

The Scottish Illegal Money Lending Unit (SIMLU) is part of Trading Standards Scotland and works in partnership with other agencies and organisations across Scotland to help to clamp down on the scourge of illegal money lenders, often known as loan sharks. The SIMLU consists of specialist officers who investigate allegations of illegal money lending and related activity, submitting reports to the Procurator Fiscal as appropriate. The team also supports victims of illegal money lending and awareness of the dangers of borrowing from loan sharks.

You can report a loan shark by using their telephone service on 0800 0744 0878 which is free and confidential and operates 24/7. Or use their online service on stopillegallending.co.uk.

What is the Government doing?

The Centre for Social Justice compiled a report called ‘Swimming with Sharks’ that exposes the scope of illegal money lending and who is affected, and the victims' experiences. The CSJ is calling on the UK Government to act in several ways which includes scaling up illegal money lending teams (across England) to allow then to respond more intensively to the ongoing appearance of loan sharks preying on disadvantaged people in our communities.

The Government should also amend the Financial Services and Markets Act 2000 to increase the tariff for the most heinous cases of illegal lending and achieve parity with fraud. Finally, the Government should use the Online Harms Bill to ensure social media platforms are responsible for detecting and banning illegal lending from their platforms.

Where can I get the money I need?

The Renfrewshire Affordable Credit Alliance or RACA for short, has brought together the five credit unions covering Renfrewshire and other responsible lenders to provide you with alternative options if needing money in an emergency or fast. Affordable credit is a term that means a more affordable, responsible and legal way to borrow money. The type of agencies that offer affordable credit are credit unions, and lenders such as Scotcash Responsible Finance or Fair for You - an online high street helping struggling families to get household items. Affordable credit is an option for people if they need:

- A small amount of money

- A product in an emergency

- Money or a loan based on what they can afford to pay back

- Provides a way to save regularly for big occasions such as Christmas or household items.

Regularly saving small amounts can help people if an unexpected life event occurs. There are five credit unions in Renfrewshire, and you can find them all on the RACA website; raca.org.uk. To join a credit union, you will need ID and Proof of Address to join and a small joining fee to activate the account. To find out more about all these affordable credit providers please explore raca.org.uk.

#AskTheQuestion campaign will run throughout May online. To support it please follow @StopLoanSharks and @RenfrewshireAf1 to keep up to date.

Sources:

- www.StopIllegalLending.co.uk campaign website

- CSJ analysis of Illegal Money Lending Team data

- https://www.theguardian.com/money/2022/mar/20/debt-loan-sharks-circle-uk-families.